Written by Peter Smith | Finance Executive/Consultant

For many investors, understanding how shifting market conditions translate into real opportunities is just as important as the numbers themselves.

Median Property Price

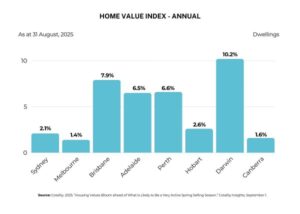

Australia’s median property price has now increased for seven consecutive months, after rising another 0.7% in August, according to property data and analytics provider Cotality.

Three main factors have been driving this price growth, Cotality said:

- The three interest rate cuts in 2025 have increased buyers’ borrowing capacity.

- Wages have been rising faster than inflation, further increasing borrowing capacity.

- Demand has been exceeding supply – the number of homes being purchased is about 4% higher than the five-year average, but the number of homes being listed for sale is about 20% below the average for this time of year.

Arranging Finance

Why get a pre-approval before you start your property search:

- Show you’re serious – sellers and agents generally prefer dealing with buyers who already have their finance in place.

- Know your limit – knowing how much you can borrow means you won’t waste time looking at homes you can’t afford.

- Act fast – when you find your dream home, you can make a firm offer without waiting for the bank.

It may be time to review your loans to determine if they are still working for you. To have them reviewed, please contact Peter on 0438 945 588 or peter@redfinance.net.au

Useful Resources:

Basic Investment Principles – How to Choose a Portfolio

Contact Us

Give Us a Call on +61 7 3666 0091

Email us at email@mobilityas.com.au

Let’s Stay Connected

Follow us for tips, updates, and more: