“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

— Paul Samuelson, 1970 Nobel laureate in economic sciences

Written By David Bartels | Financial Adviser

When it comes to investing and constructing a portfolio, the seemingly endless options can feel overwhelming. Shares, bonds, managed funds, ETFs, direct shares, asset classes, geographic regions, risk levels,…… – the choices are vast and often confusing.

This guide outlines six evidence-based principles to help you invest wisely, take control of your financial future and sleep well at night.

1. Start With Your Why?

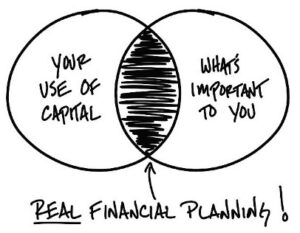

Source: Real Financial Planning – Carl Richards

The first step in building an investment portfolio is understanding why you’re investing.

- Are you investing for retirement, a property purchase, funding your children’s education or something else important to you?

- What’s your time horizon?

- How much risk are you comfortable taking?

Your portfolio should be designed around your life goals. This means clearly defining your time horizon (how long you’ll be investing) and your capacity for risk (your tolerance for fluctuations in the value of your portfolio). Risk tolerance is both emotional (how well you sleep at night during downturns) and financial (how much loss you can endure without jeopardising your goals).

“Successful investing is about managing risk, not avoiding it.”

— Ben Graham

2. Choose the Right Asset Allocation

“The function of economic forecasting is to make astrology look respectable.”

— John Kenneth Galbraith

Once your goals are clear, the next step is deciding on your asset allocation i.e. how much of your portfolio goes into different types of assets classes like shares, bonds, and cash.

The key is aligning the mix to your risk tolerance and investment horizon.

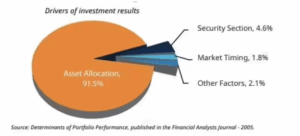

Asset allocation is the single most important factor in determining your long-term investment returns, with research showing it contributes over 90% of the total return on a portfolio.

Source: Financial Analysts Journal; Volume 61, 2005

Rather than stock-picking or trying to time the market, a well-diversified allocation across asset classes is far more effective. This goes against many investors’ long held beliefs that assume that picking the best shares, and jumping in and out of the market is the way to achieve success.

3. Tax: Be smart

“The surest way to compound wealth is to minimise taxes and fees.”

— Burton Malkiel, author of A Random Walk Down Wall Street

Tax can significantly impact how much of your investment returns you actually get to keep.

Assuming a long-term investment timeframe, the ownership of your portfolio will have the biggest impact on how much tax you pay.

For example, do you own it in your name, your spouse’s name, jointly, or in an entity such as a trust, company, investment bond or self-managed superannuation fund (SMSF)?

So it makes good sense to consider this carefully, along with expert tax planning advice from your accountant and/or other relevant professionals is important to minimising paying a lot of unnecessary tax.

4. Diversify

“Diversification is the only free lunch in investing.”

— Harry Markowitz, Nobel Laureate and father of Modern Portfolio Theory

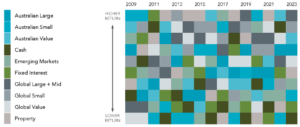

Source: Dimensional Fund Advisors using data from: S&P Data © 2024 Dow Jones Indices LLC, a division of S&P Global; MSCI 2024; Bloomberg

Diversification spreads your investments across global markets and multiple asset classes to reduce risk without sacrificing returns.

Many Australian-based investors fall into the trap of home bias—investing too heavily in Australian shares or other local assets. Diversifying across global markets enables you to capture broader growth and reduce reliance on any single economy,

Within asset classes, diversification also matters. For example, in shares, investors should include both large cap and small cap companies, and consider factors such as value versus growth investing.

5. Minimise Investment Costs

“It’s not what you earn, it’s what you keep that counts.”

— Unknown

Costs erode your investment returns more than most people realise. Management fees, fund charges, and transaction costs compound over time.

There are 3 key investment management approaches:

- Passive/index i.e. tracking an index like the S&P500 rather than trying to beat it. The fees are typically a fraction of what active managers charge.

- Passive/index with a factor-based overlay i.e. as above but with more of a tilt to factors such as value and profitability. The fees are typically slightly higher than a passive/index approach, but still much lower than what active managers charge.

- Active/conventional i.e. trying to outperform the market by stock-picking, timing the market or other strategies. The fees for this approach are typically much higher than the above.

For asset classes like large cap, developed market shares, academic research shows that passive investing consistently outperforms the majority of active fund managers over the long term, especially after fees.

Thus, it makes sense to follow the evidence, as the less you pay in costs, the more of your return you get to keep.

6. Avoid Emotional Investing

“It’s not brains that make you money, it’s emotional discipline.”

— Charlie Munger

Source: Dimensional Fund Advisors

News headlines, social media, economic forecasts, and share tips may be interesting, but they rarely help long-term investors. Reacting to short-term events often leads to poor decisions—panic selling, chasing hot stocks, or abandoning a long-term strategy.

Successful investing is less about predicting the future and more about managing behaviour. The ability to stay the course through volatility is often the deciding factor between success and failure.

“The intelligent investor is a realist who sells to optimists and buys from pessimists”

— Ben Graham

Final Thoughts: A Portfolio and Plan You Can Live With

“A good plan now is better than a perfect plan executed at some indefinite time in the future”

— George S Patton Jr., American general

In summary, to position yourself best for long-term success, create an investment portfolio that:

- Aligns with your financial goals and tolerance for risk.

- Diversify globally.

- Manage expenses, turnover and taxes.

- Remove as much emotion as possible via an evidence-based approach

- Stay disciplined during the markets’ inevitable highs and lows.

📞 Want an investment plan tailored to you? Give us a call on +61 7 3666 0091 — we’re here to help.

Useful Resources:

Contact Us

Give Us a Call on +61 7 3666 0091

Email us at email@mobilityas.com.au

Let’s Stay Connected

Follow us for tips, updates, and more: